Abdul Latif Jameel and Ant International Unite to Boost Saudi Fintech Scene

3 min

Abdul Latif Jameel Finance partners with Ant International to enhance fintech for Saudi MSMEs.

The collaboration focuses on inclusive digital financial solutions for businesses and consumers.

Integration plans include linking Alipay+ with Saudi's mada payment network by 2026.

Challenges around data sharing and regulation may complicate the partnership's progress.

Success could significantly ease financing issues for small traders in the region.

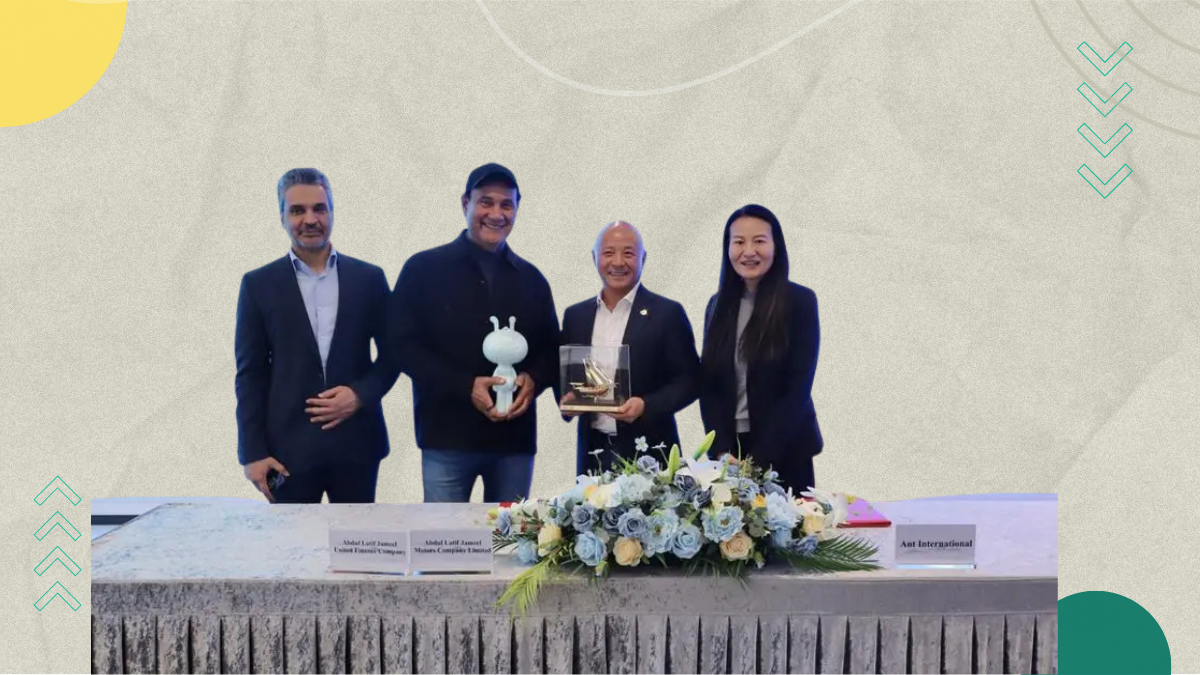

It’s always encouraging to see fresh partnerships taking shape in the Saudi fintech landscape — and the latest one caught my eye for good reason. Abdul Latif Jameel Finance, known for its forward-looking financial services and regulated by the Saudi Central Bank, has signed a Memorandum of Understanding with Singapore-based Ant International. The aim? To boost the capabilities of micro, small and medium-sized enterprises (MSMEs) across the Kingdom through smarter digital tools.

From what’s been shared, both parties intend to roll out a mix of innovative digital financial solutions for both businesses and consumers. Dr Khalid Alsharif, the CEO of Abdul Latif Jameel Finance, described the collaboration as a “significant step” towards more inclusive financial opportunities in Saudi Arabia. He linked the move to Vision 2030’s wider goals — hardly surprising given how heavily the country is investing in technology and entrepreneurship right now.

Over on Ant International’s side, Senior Vice President Leiming Chen said the tie-up builds on their ambition to support Saudi Arabia’s digital economy. And Clara Shi, CEO of WorldFirst — which sits under the Ant umbrella — added that the partnership will combine Ant’s fintech know-how with Abdul Latif Jameel Finance’s local ecosystem to fuel regional trade and commerce. That’s quite a promise, though I reckon the proof will come once those digital offerings actually go live.

Ant International, if you’re not familiar, operates across Asia, Europe, the Middle East and Latin America. It runs several brands — including Alipay+, Antom, WorldFirst and Bettr — each focusing on different aspects of payments, accounts, and embedded finance. Interestingly, the company opened its first Middle East office in Riyadh earlier this year, and there’s talk of integrating Alipay+ with Saudi Arabia’s own mada payment network by 2026. That’s a spot-on way of weaving into the local infrastructure rather than standing apart from it.

As for Abdul Latif Jameel Finance, its track record is already solid. Last year alone, it financed more than SAR 3.5 billion in microloans through its Bab Rizq Jameel programme — helping nearly 300,000 small businesses and entrepreneurs. From what we often hear at Arageek, access to finance has long been a bit of a faff for many small Saudi firms, so partnerships rooted in digital inclusion really could shift the needle.

On the flip side, collaborations like this always raise questions about data sharing, regulation, and operational hiccups — things that can complicate even the best intentions. Still, having seen firsthand how small traders in the region struggle to manage payments or credit assessments, I’d say moves like this are definately steps in the right direction.

In the end, both sides seem to be betting that technology and local know-how can work hand in hand to open more doors for SMEs across the Kingdom. And if it pans out as they hope, entrepreneurs from Jeddah to Dammam might just find life a little easier — and their future, a lot brighter.

🚀 Got exciting news to share?

If you're a startup founder, VC, or PR agency with big updates—funding rounds, product launches 📢, or company milestones 🎉 — AraGeek English wants to hear from you!

✉️ Send Us Your Story 👇

LEAP26

LEAP26 AI

AI Saudi Arabia

Saudi Arabia UAE

UAE Egypt

Egypt