Botim and Binance Collaborate to Unlock Crypto Access for UAE Users

3 min

Botim and Binance signed an MoU in Dubai to explore digital asset access for UAE users.

The collaboration aims to combine Binance's expertise with Botim's growing fintech infrastructure.

They intend to provide regulated crypto access to increase financial inclusion in underserved communities.

Botim, part of Astra Tech, seeks to become an AI-native, fintech-first platform with secure tools.

The MoU highlights the UAE's commitment to integrating traditional and digital finance sectors.

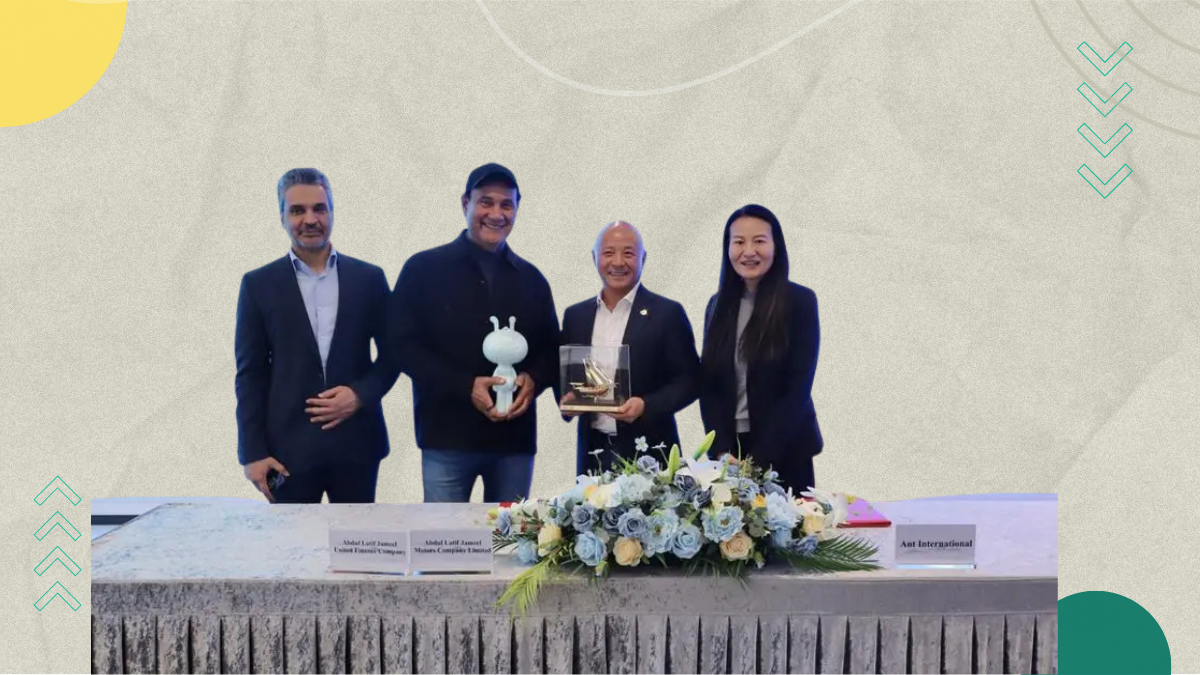

Botim’s financial arm has taken another step toward becoming a full fintech hub, signing an MoU with Binance to look into giving millions of UAE users easier access to digital assets. The agreement was formalised during Binance Blockchain Week in Dubai, which felt spot on given how the city has become a magnet for crypto and Web3 conversations lately.

The plan, as outlined in the MoU, is to explore how Binance’s experience with digital assets could be blended with botim’s growing fintech infrastructure. Nothing is going live just yet, but both sides are studying what safe, compliant access to crypto might look like within the UAE’s regulatory environment. And believe it or not, this isn’t just a tech play — it’s also about widening financial participation for communities who’ve been underserved for years.

One thing I’ve seen often when speaking with startups around the region through Arageek is how financial inclusion can be a bit of a faff. Many people still struggle with basic access to banking services, so the idea of giving them simple, regulated ways to use digital assets may actually move the needle. I reckon that’s the bit that will matter in the long run.

Catherine Chen, Binance’s Head of VIP and Institutional, noted that crypto is no longer a niche corner of finance, adding that making it accessible to botim’s large user base reflects how mainstream the sector has become. She also pointed to the UAE’s momentum in bridging traditional and digital finance.

Sacha Haider, Chief Strategy Officer at Astra Tech, which owns botim, highlighted how deeply botim money is already embedded in people’s daily financial routines. The company runs significant peer‑to‑peer payment flows, and Haider said exploring crypto features with Binance could help users engage more confidently with the digital economy. Their focus, she stressed, remains on providing tools that are both simple and secure.

Botim money, previously known as PayBy, sits at the heart of Astra Tech’s push to turn botim into one of the region’s first AI‑native, fintech‑first platforms. The service is licensed by the UAE Central Bank and offers everything from digital wallets and remittances to in‑store payments. Its B2B arm also supports regional enterprises with payments infrastructure and compliance tools. That said, despite all the buzz, the companies are still in the exploration phase — so anyone expecting instant crypto transfers through botim might have to wait a bit longer, unfortunatly.

On the flip side, the MoU signals how seriously the UAE is taking digital finance. With more than 157 million botim users worldwide and Binance’s global footprint, even a pilot rollout could shift the landscape. And as someone who’s watched countless MENA founders struggle to plug gaps in financial access, I can’t help but feel a bit chuffed to bits seeing mainstream players finally lean into solutions that might actually scale.

🚀 Got exciting news to share?

If you're a startup founder, VC, or PR agency with big updates—funding rounds, product launches 📢, or company milestones 🎉 — AraGeek English wants to hear from you!

✉️ Send Us Your Story 👇

AI

AI Saudi Arabia

Saudi Arabia UAE

UAE Egypt

Egypt