BBK and Binance Forge Landmark Crypto Integration for GCC Banking App

3 min

BBK signed an MoU with Binance Bahrain for GCC’s first in‑app “crypto as a service” model.

The deal hinges on Central Bank approval, but could reshape regional digital asset banking.

Binance’s white‑label crypto tools would slot into BBK’s app via “plug‑and‑play APIs”.

Customers could trade, hold and manage crypto alongside regular accounts in one dashboard.

The partnership supports Bahrain’s ambition to be a regulated crypto innovation hub.

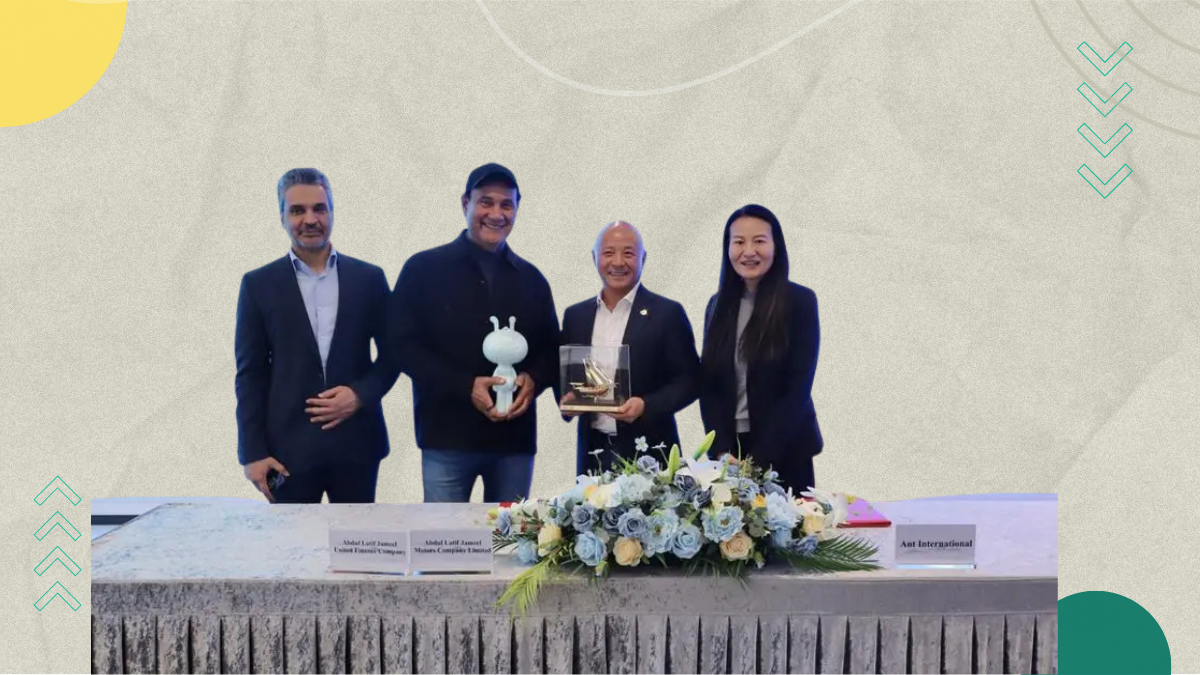

Bank of Bahrain and Kuwait has signed a memorandum of understanding with Binance Bahrain, setting the stage for what could become the GCC’s first full “crypto as a service” integration inside a traditional banking app. The agreement, announced during the Gateway Gulf Investment Forum Bahrain 2025, is still subject to final approval from the Central Bank of Bahrain, but if it goes through, it will mark a notable step in how digital assets are offered in the region.

Under the arrangement, BBK is set to join the Binance Link Programme, making it the first bank in the GCC to do so. In practical terms, this means Binance Bahrain’s white-label crypto service will be plugged directly into the BBK mobile app through what the companies describe as secure, plug-and-play APIs. Customers would be able to trade and manage cryptocurrencies without opening or juggling a separate Binance account. Everything would sit in one place, well… you know, like any other banking product.

There will be a dedicated in-app dashboard for digital assets, allowing users to view holdings, make transactions and manage crypto alongside their regular accounts and investments. For anyone who has tried to manage finances across five different apps, that kind of consolidation feels spot on. I remember chatting with a founder at an Arageek meetup who called crypto onboarding “a bit of a faff” for banks; this deal seems designed to smooth exactly that pain point.

BBK’s Group Chief Executive Yaser Alsharifi said the partnership reflects the bank’s push on innovation and customer-focused digital transformation, adding that the aim is to offer access to new asset classes while keeping the trust and reliability customers expect from a bank. From Binance Bahrain’s side, its general manager Tameem Al Moosawi noted that working with a regulated local bank helps widen access to digital assets and reinforces Bahrain’s position in regulated crypto innovation across the region.

Catherine Chen, who heads VIP and institutional business at Binance, pointed to growing global demand for digital assets and said the collaboration helps BBK offer crypto services at scale, setting what she described as a benchmark for institutional adoption in the GCC. That said, I reckon the real test will be how intuitive the final product feels to everyday users, not just how shiny the technology looks on paper.

By combining BBK’s existing banking infrastructure with Binance Bahrain’s regulated crypto expertise, the partnership also ties into Bahrain’s broader ambition to be a regional hub for crypto-asset trading and financial innovation. Once regulatory approvals are secured, BBK customers will be able to access crypto trading and management directly through the bank’s app, potentially nudging digital assets a little further into the mainstream. For startups watching this space from the sidelines, esppecially those building fintech tools in MENA, this is one development worth keeping an eye on.

🚀 Got exciting news to share?

If you're a startup founder, VC, or PR agency with big updates—funding rounds, product launches 📢, or company milestones 🎉 — AraGeek English wants to hear from you!

✉️ Send Us Your Story 👇

AI

AI Saudi Arabia

Saudi Arabia UAE

UAE Egypt

Egypt