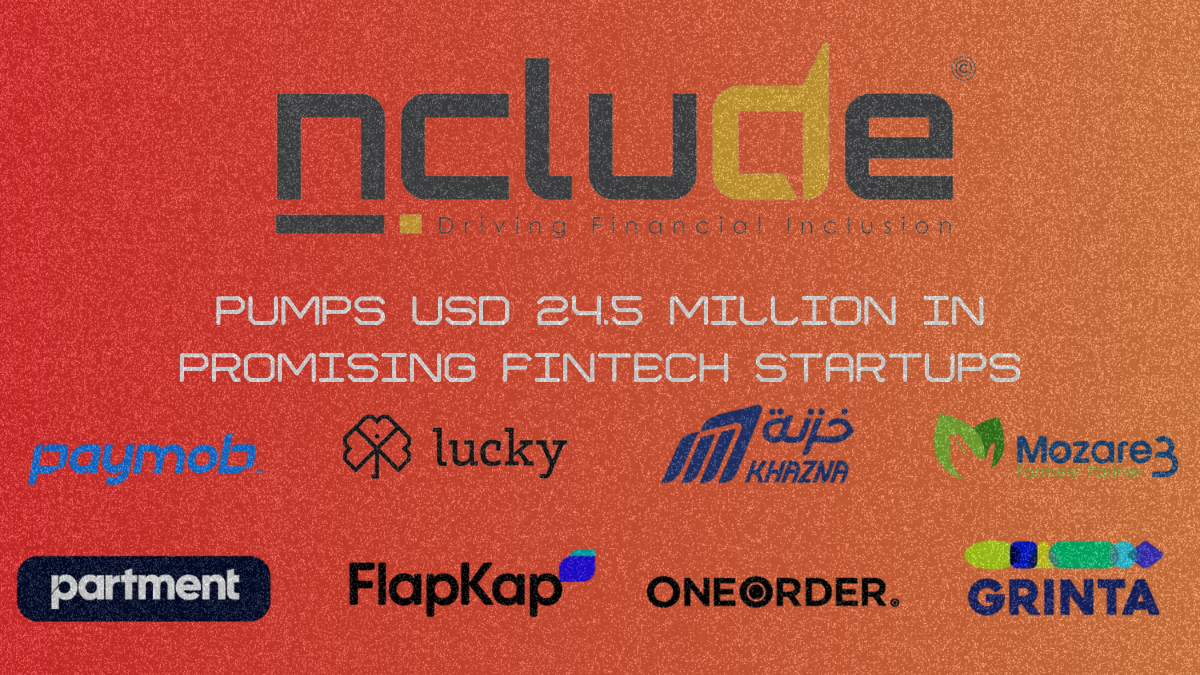

Nclude Fund’s $24.5 Million Boost Ignites Egypt’s Fintech Revolution

2 min

Total Capital Surpasses $105 Million: Nclude Fund's investment elevates its capital to new heights.

Attracting Foreign Investment: Every dollar Nclude invests lures an additional five dollars from overseas backers.

Management Transition to DPI: In March 2023, the Central Bank of Egypt handed over the fund's reins to Development Partners International (DPI).

Positioning Egypt as a Fintech Hub: The fund aims to spotlight Egypt as a leading center for fintech innovation in the Middle East and Africa.

Egypt's fintech scene is buzzing like never before, and for good reason. The Nclude Fund has just injected a whopping $24.5 million into eight of the nation’s most promising fintech startups:

This isn’t merely a financial transaction; it’s a bold statement of confidence in Egypt’s burgeoning digital economy. By pushing the fund’s total capital over the $105 million milestone, Nclude is signaling its commitment to fostering innovation and financial inclusion across the country.

But the excitement doesn't stop there. For every dollar Nclude has poured into these startups, an astounding five dollars have flowed in from foreign investors. It's as if the international investment community has suddenly zeroed in on Egypt, recognizing the untapped potential and eager to grab a slice of the action. This multiplier effect is more than just numbers on a balance sheet—it's a testament to the growing global faith in Egypt's fintech potential.

Let's rewind a bit to when Nclude was founded in March 2022. It wasn't just another fund launch; it was a collaborative brainchild of some heavy hitters—Banque Misr, National Bank of Egypt, and Banque du Caire—teaming up with fintech specialists like eFinance Investment Group and Mastercard. Their mission was ambitious yet crystal clear: kickstart Egypt's leap into a digitally-driven, financially inclusive future and stake a claim as a powerhouse of fintech innovation in the Middle East and Africa.

What's genuinely inspiring about Nclude is how it's rolling up its sleeves to support early-stage startups. They're not just writing checks and walking away; they're in the trenches, offering strategic guidance and leveraging their networks to help these young companies thrive. This hands-on approach is fostering innovative financial solutions tailored to the diverse needs of Egyptians—from bustling Cairo to the more remote corners of the country.

In the grand scheme of things, Nclude's latest moves are a win-win. Startups get the much-needed capital and support to innovate, investors tap into a hot market with promising returns, and Egypt steps confidently onto the global fintech stage.

Walking through the streets of Cairo, you can almost feel the electric vibe of innovation in the air. Entrepreneurs are buzzing with ideas, accelerators are popping up, and there's a palpable sense that something big is happening. Egypt isn't just participating in the fintech revolution; it's gearing up to lead the charge.

AI

AI Saudi Arabia

Saudi Arabia UAE

UAE Egypt

Egypt