The Voices to Watch at FII9: Who I’m Most Excited to Hear From in Riyadh

8 min

Riyadh is hosting the 9th edition of the Future Investment Initiative (FII9), bringing together global leaders in technology, economics, and politics.

The event focuses on artificial intelligence, energy, economic transformation, and sustainable investment.

Among the speakers are Amin Nasser, Cathie Wood, Alex Clavel, Mohammed Al Abbar and Yasir Al Rumayyan.

There is a strong presence of Arab AI-entrepreneurs such as Emad Massad and Mai Habib.

The conference has become a platform shaping the next decade of innovation and global transformations.

This week, Riyadh hosts the ninth edition of the Future Investment Initiative (FII9) — the annual gathering often described as “Davos in the Desert.” Few events bring together such a diverse range of leaders in politics, investment, business, and technology. It’s a place where capital meets conviction, and where ideas once considered bold begin to define global priorities.

This year, the conversations feel especially timely. The world is moving through an era of accelerated change, driven by artificial intelligence, energy transitions, and shifting geopolitical realities. Here are the speakers I’m most excited to hear from at FII9, and why.

Abeer M. AlAkel, Royal Commission for AlUla

AlUla remains one of the most remarkable cultural stories to emerge from Saudi Arabia, a fusion of history, sustainability, and modern design. AlUla has evolved from a heritage site into a living destination that celebrates both the past and the future. I’m eager to hear how she envisions the next phase of AlUla’s development, and how Saudi Arabia plans to sustain tourism while preserving authenticity and ecological balance.

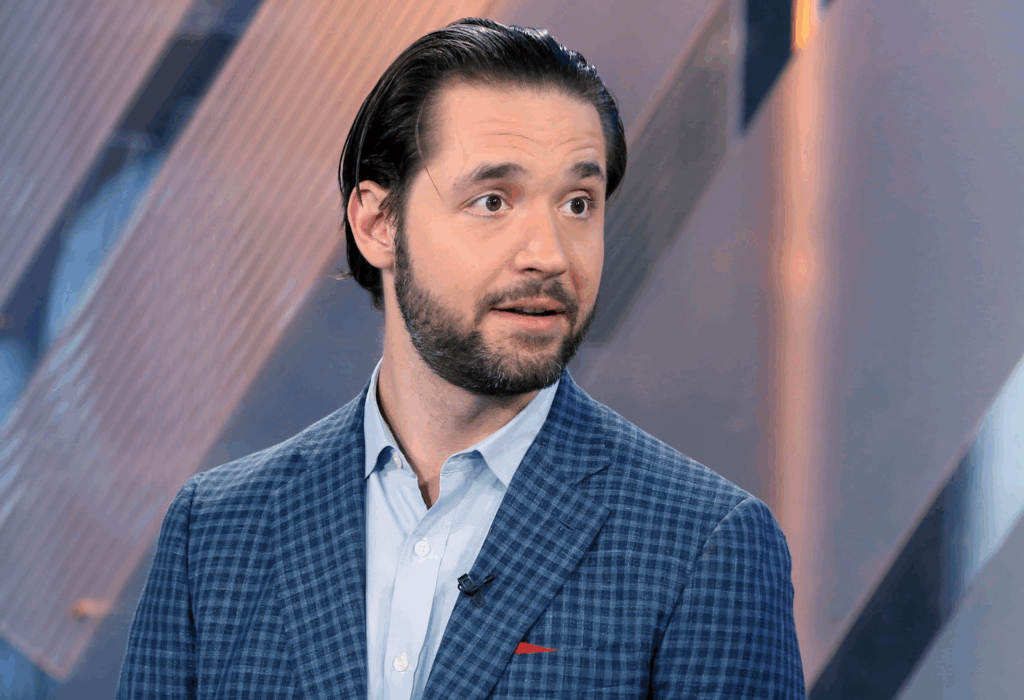

Alex Clavel, SoftBank

Few institutions have had a greater impact on global technology than SoftBank. After years of highs and recalibrations, the firm’s focus on AI and infrastructure, particularly through its Stargate initiative, marks a fascinating evolution. I’m curious to hear how Alex Clavel frames SoftBank’s next chapter: is it another era of bold bets, or a disciplined focus on long-term platforms powering the AI economy?

Alexis Ohanian, 776 & Reddit

Alexis represents the intersection of technology, creativity, and social influence. From co-founding Reddit to building the venture firm 776, his worldview captures how communities drive innovation. I’m especially interested in his perspective on the creator economy and how technology can empower individuals to build sustainable platforms without relying on traditional media and financial gatekeepers.

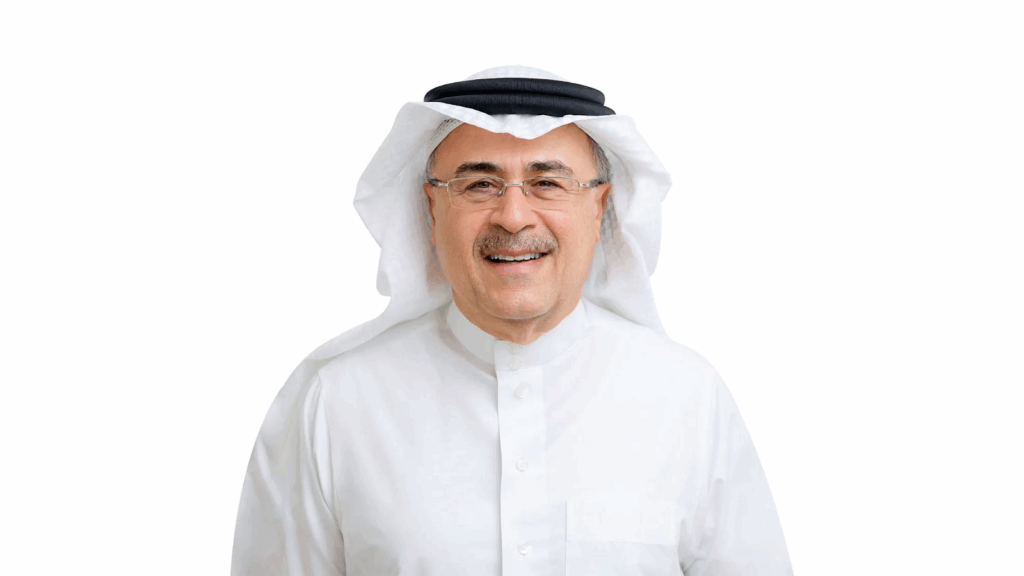

Amin Nasser, Aramco

Energy remains the foundation of every major economic transition, and no one sits closer to that intersection than Amin Nasser. Aramco is not only the world’s largest energy company, it’s also redefining its role in the age of decarbonization. I’m keen to hear how Nasser envisions the next phase of global energy, balancing the urgency of sustainability with the realities of demand and geopolitics.

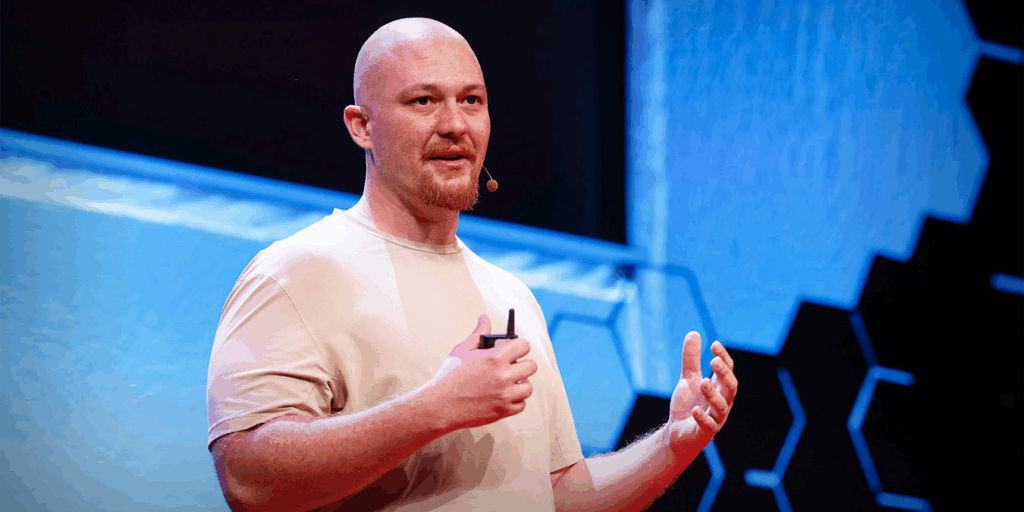

Amjad Masad (Replit) & May Habib (Writer)

It’s inspiring to see two Arab founders leading globally recognized AI companies. Amjad and May each represent a new wave of leadership, technologists who are reshaping how software is written and how content is created. Replit has become a global hub for developers, while Writer is building one of the most promising enterprise AI platforms. Their stories signal a broader truth: Arab innovators are no longer peripheral in global tech; they are central to its progress.

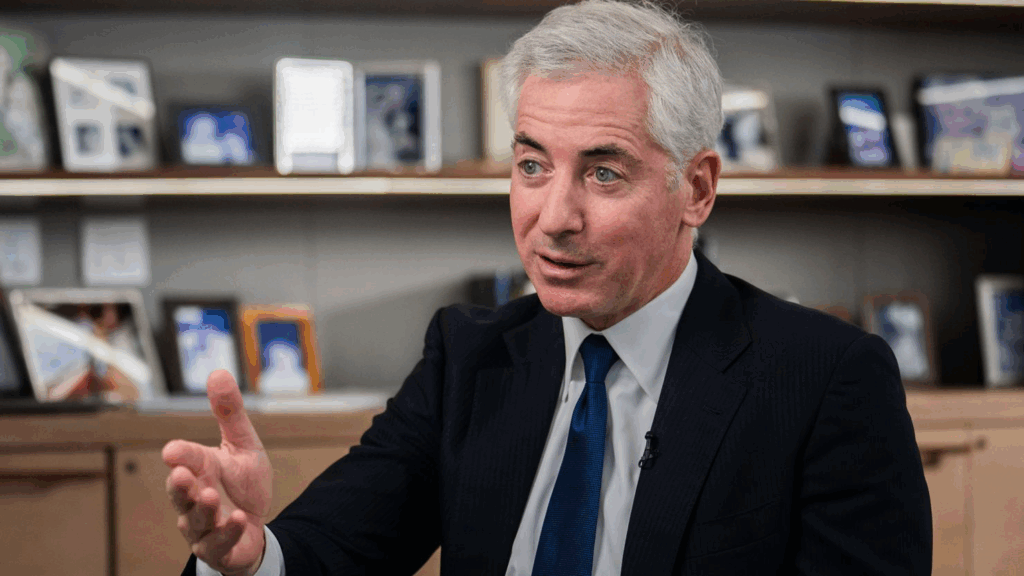

Bill Ackman, Pershing Square Capital Management

Bill Ackman is one of the few investors whose opinions move markets and shape policy debates. His macroeconomic and political analysis tends to cut through noise, whether you agree with him or not. I expect his FII session to offer blunt insights on inflation, U.S. politics, and what investors should brace for in 2026.

Cathie Wood, ARK Invest

Cathie Wood’s conviction in exponential technologies has made her both celebrated and controversial. She has been early — often too early — on many trends that are now mainstream. I’m looking forward to hearing her defend her belief in Elon Musk’s proposed $1 trillion compensation package and how she sees innovation cycles evolving in an era where investors have become more short-term than visionary.

Cristiano Amon, Qualcomm

Microchips are the invisible force behind the modern world, and they’ve become a new axis of global politics. Cristiano Amon has led Qualcomm through one of the most complex supply-chain and regulatory landscapes in tech. His insights on where semiconductor innovation is heading and how AI will redefine connectivity are critical for understanding the world’s digital infrastructure race.

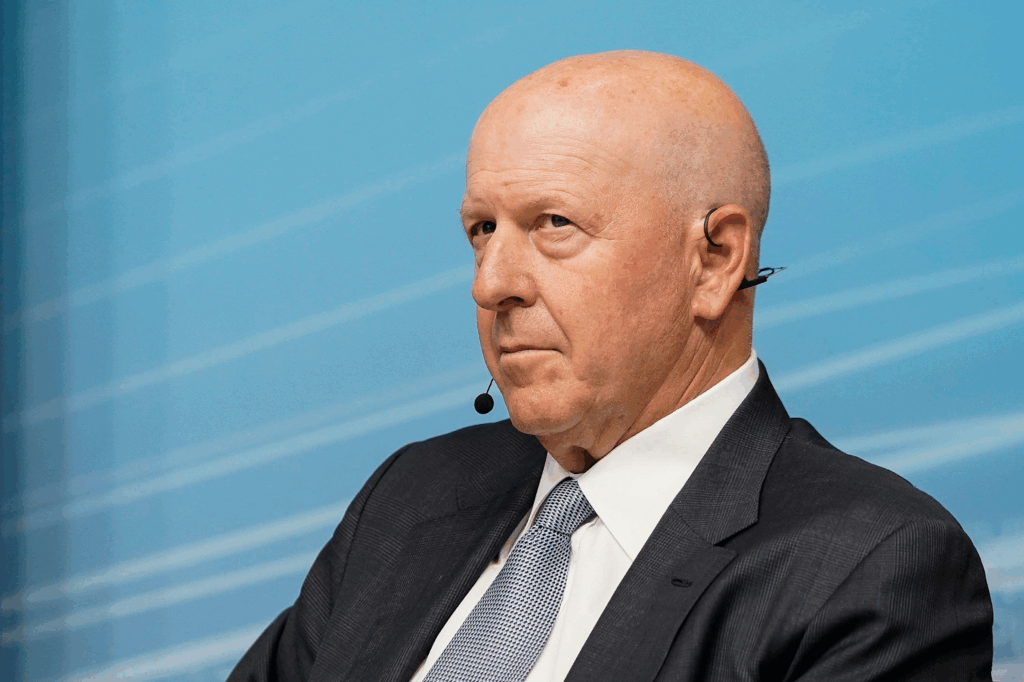

David Solomon (Goldman Sachs), Jamie Dimon (J.P. Morgan), and Laurence D. Fink (BlackRock)

When these three share a stage, the conversation defines the financial mood of the year. Each represents a pillar of global finance (investment banking, traditional banking, and asset management). I’m hoping for an honest discussion about whether the world should still expect a recession, how liquidity is shifting across regions, and how they see capital allocation evolving as AI begins to reshape industries.

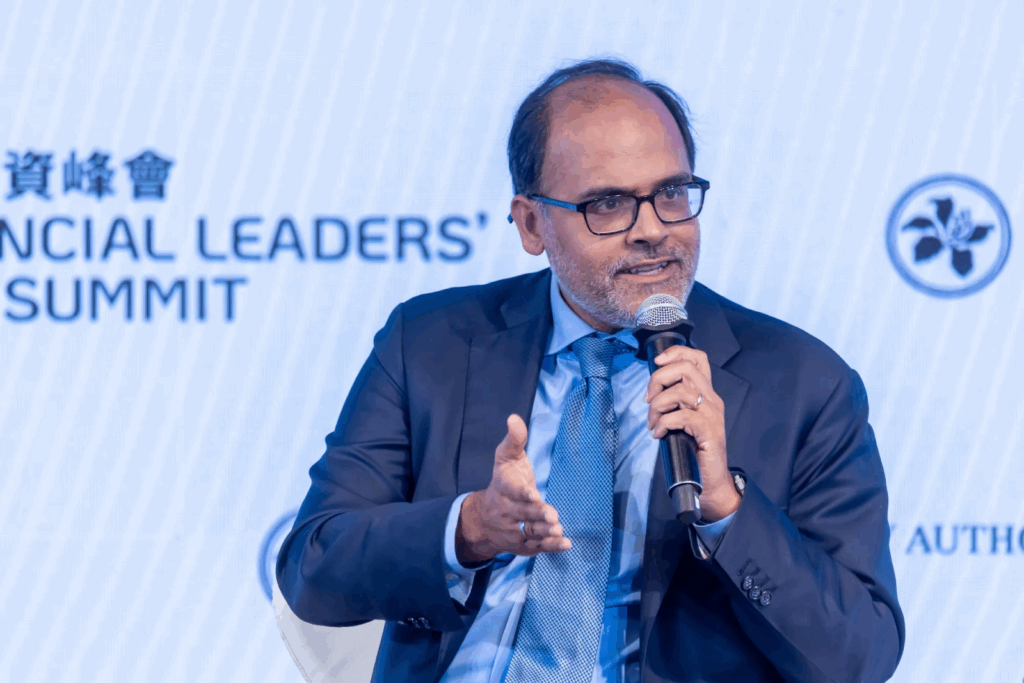

Deven Parekh, Insight Partners

Deven has one of the clearest, most grounded perspectives in venture capital. After hearing him speak at SVC’s Private Capital Forum, I was struck by how thoughtfully he analyzes long-term value creation. I’m looking forward to his thoughts on what comes next, particularly how AI will affect enterprise SaaS, infrastructure, and late-stage investing.

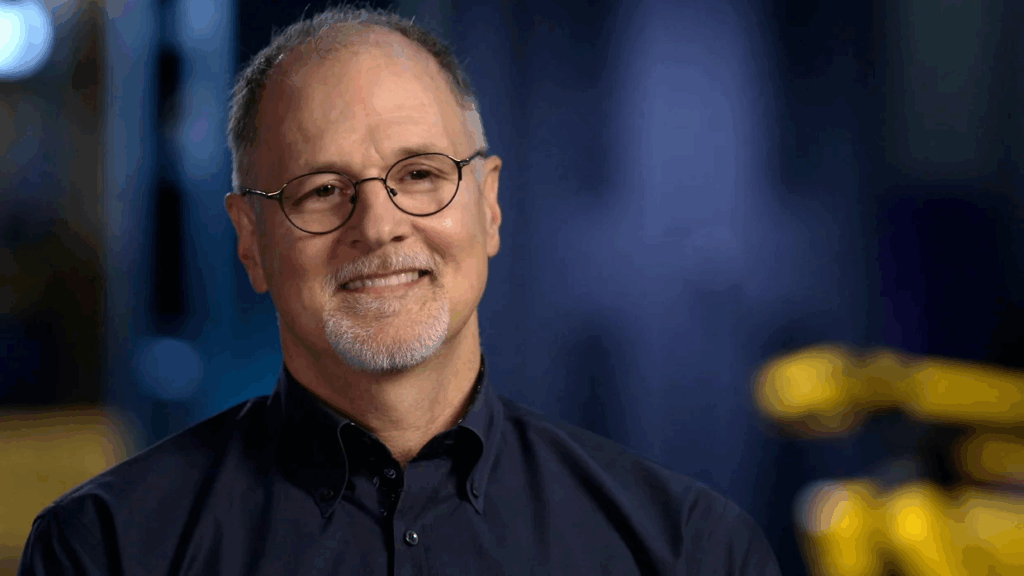

Robert Playter, Boston Dynamics

For years, robotics was a promise perpetually on the horizon. Under Playter’s leadership, Boston Dynamics has finally crossed into commercialization from logistics and industry to security and beyond. I’m eager to hear how robotics will integrate into everyday life and what ethical and labor implications come with that. The question is no longer whether robots can do the work, but how society adapts when they do.

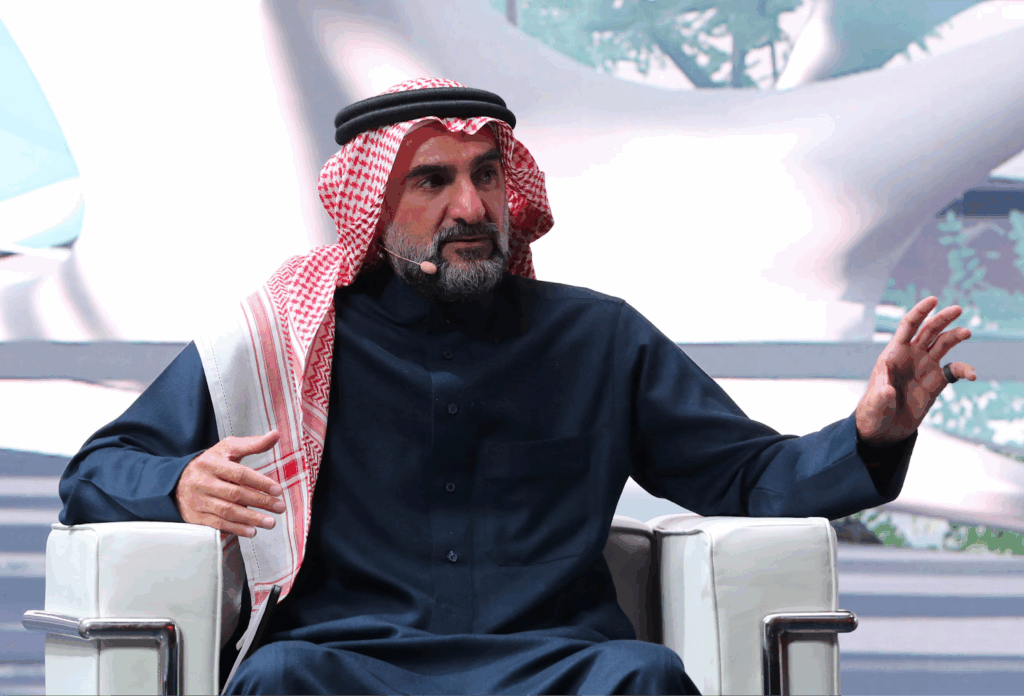

Yasir Al-Rumayyan, PIF

Yasir Al-Rumayyan’s leadership of PIF has redefined what sovereign wealth funds can achieve. From sports and entertainment to deep technology and infrastructure, PIF has become one of the most influential investment vehicles in the world. I’m interested to hear how he frames the fund’s next decade, especially its strategic tilt toward AI, data centers, and national tech infrastructure. His decisions often signal not just Saudi priorities but global market shifts.

HRH Prince Khaled bin Alwaleed bin Talal Al Saud

Prince Khaled has been a consistent voice for sustainability, wellness, and ethical investment long before these themes became mainstream. His approach combines entrepreneurship, impact investing, and policy. I’m curious about his upcoming ventures in health and sustainability, and how he plans to scale them globally while staying rooted in regional innovation.

Hussain Sajwani, DAMAC

Sajwani’s recent expansion into AI infrastructure in the United States is one of the boldest moves by a GCC businessman this year. It’s a clear bet that the next wave of real estate value will come from powering digital economies, not just from building physical ones. His ability to connect real estate, data infrastructure, and capital markets makes his session one of the most intriguing to watch.

Mike Sicilia, Oracle

Oracle is quietly becoming one of the most important players in AI infrastructure. With the company’s deep government ties and rumored interest in TikTok’s U.S. operations, Sicilia’s perspective could shed light on how enterprise software giants are reinventing themselves for the AI-first world.

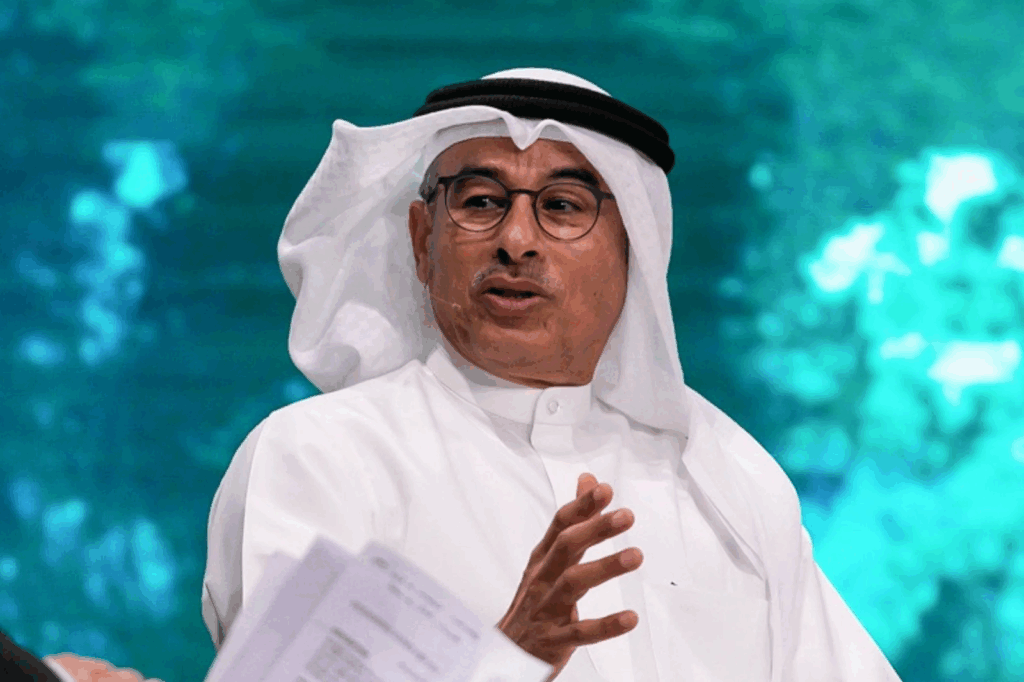

Mohamed Alabbar, Emaar

Alabbar has always been one of the region’s most influential and outspoken businessmen. His perspective on real estate, urban development, and politics often pushes the conversation forward. I expect his insights to challenge conventional thinking about where the Middle East’s real-estate market is heading and how cities can evolve beyond construction into living ecosystems of culture and innovation.

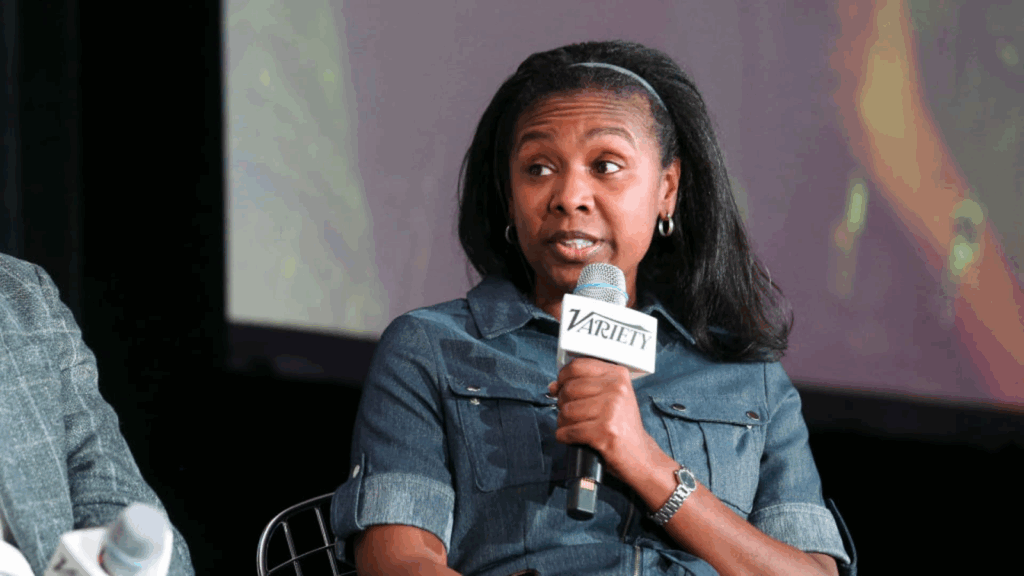

Portia Archer, WTA

Sports are evolving into powerful platforms for culture and technology, and Archer’s leadership at the Women’s Tennis Association is a case in point. Women’s tennis has immense potential to engage new generations of fans — if it can adapt. I’m looking forward to her insights on global partnerships, athlete storytelling, and how the WTA plans to grow its global reach in an increasingly digital, attention-driven landscape.

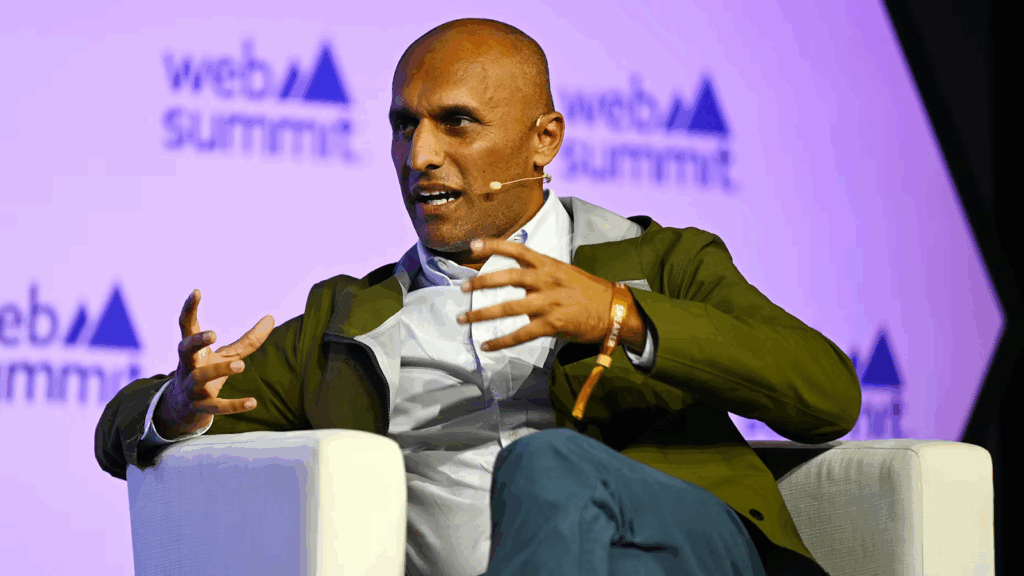

Qasar Younis, Applied Intuition

Applied Intuition is one of the most important companies that most people haven’t heard of. Its work in simulation and defense technology sits at the heart of how autonomous systems are trained and validated. As governments invest heavily in AI-driven defense, Younis’ view on safety, national competitiveness, and the commercialization of military-grade technology will be essential listening.

Ray Dalio, Bridgewater Associates

Ray Dalio has a rare ability to zoom out and see civilizations as systems. His frameworks for understanding cycles of power, debt, and innovation feel more relevant than ever in the AI era. I’m particularly interested in his perspective on how nations adapt — or fail to adapt — as technology reshapes the foundations of their economies and governance.

Sriram Krishnan, Trump’s Advisor

Krishnan bridges two worlds: Silicon Valley innovation and political realism. As the U.S. enters another period of uncertainty, his perspective on how the tech industry might evolve under a Trump administration — from regulation to innovation priorities — could be one of the more pragmatic sessions of the event.

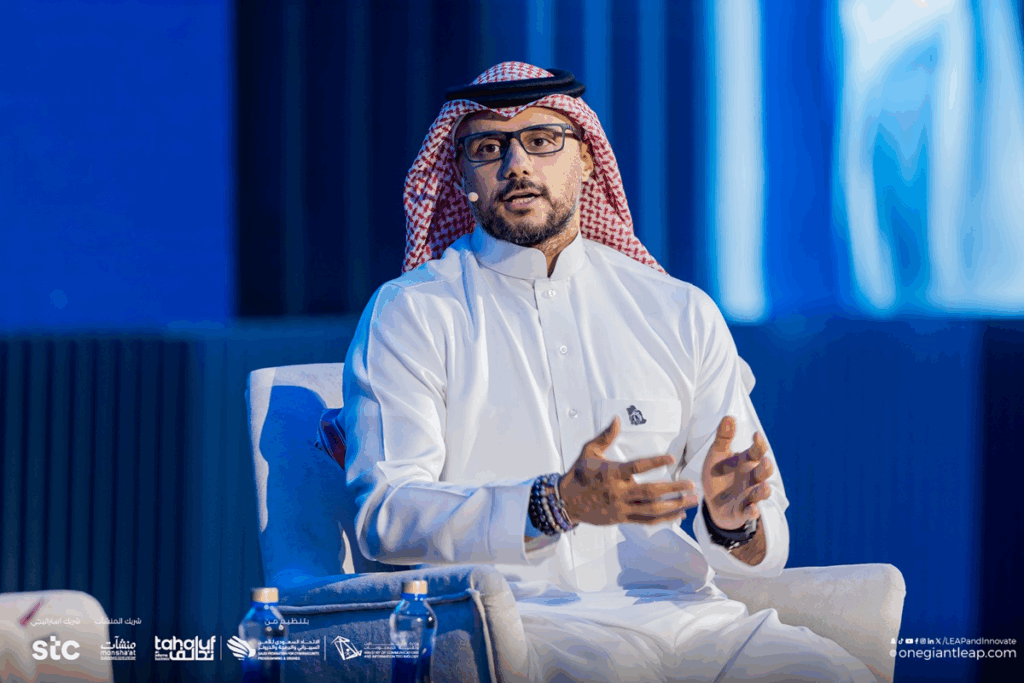

Tareq Amin, HUMAIN

Saudi Arabia’s AI ecosystem is developing rapidly, and Tareq Amin’s HUMAIN stands out as one of its most ambitious efforts. His background in telecom and infrastructure gives him a uniquely grounded view of what it takes to build AI capacity at a national scale. I’m keen to hear his thoughts on what makes Saudi’s approach to AI different — and how it can compete globally while remaining locally relevant.

FII9 feels like more than just a conference. It’s where the next decade of ideas, investments, and alliances will take shape, from energy and AI to capital markets and culture. For me, it’s also a moment to listen closely and take notes from the people designing systems, building technologies, and shaping policies that will define how we live and work in this new age.

AI

AI Saudi Arabia

Saudi Arabia UAE

UAE Egypt

Egypt